- #QUICKEN SMALL BUSINESS INVOICE FOR ANDROID#

- #QUICKEN SMALL BUSINESS INVOICE SOFTWARE#

- #QUICKEN SMALL BUSINESS INVOICE DOWNLOAD#

- #QUICKEN SMALL BUSINESS INVOICE FREE#

QuickBooks Payroll: Which Is Best for You?Ĭompare Gusto and QuickBooks Payroll to determine which one might be right for your small business. This service enters your employee’s personal and payroll data for you, prints the checks and sends them to you and processes all end-of-year tax document. Intuit also offers a full-service payroll service for a higher cost. Intuit Online Payroll requires a major credit card to complete the account-creation process.

#QUICKEN SMALL BUSINESS INVOICE FREE#

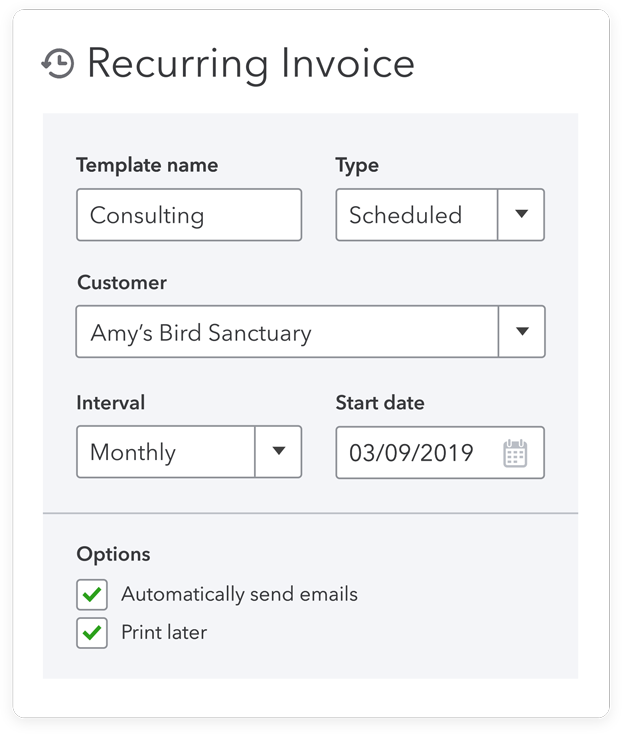

To access and use Intuit Online Payroll, navigate your Internet browser to the “Intuit Payroll – Create Account” link (see Resources) and create an account and start your free trial. The online payroll service even offers free support from payroll experts in the event you encounter a problem during payroll or tax processing. Intuit Online Payroll can also send you email reminders when your company’s payroll is due – weekly, bi-weekly or monthly.

The online payroll service also enables you to complete end-of-year tax processing including printing and processing W-2s and W-3s as well as process electronic tax filings. Intuit Online Payroll offers a 30-day free trial.

#QUICKEN SMALL BUSINESS INVOICE FOR ANDROID#

Intuit Online Payroll even includes an app for Android and iPhone smartphones for processing payroll while on the go. The service also generates payroll reports for you to manually enter the dollar amount of your payroll into Quicken Home & Business. Intuit Online Payroll calculates federal and state taxes for you and is able to directly deposit your employee’s payroll checks into their banking accounts for free. You must manually enter your employee’s personal information and work hours into the online payroll service to process your company’s payroll. Intuit Online Payroll is in no way connected to Quicken Home & Business nor is the service able to send payroll data to Quicken Home & Business. If you decide to use a standalone payroll program, you must manually enter your employee’s payroll data and hours and enter the total amount of your company’s payroll into Quicken Home & Business. The accounting program also doesn’t interface with standalone payroll programs – QuickBooks Payroll, Select Payroll or Ame Payroll.

#QUICKEN SMALL BUSINESS INVOICE DOWNLOAD#

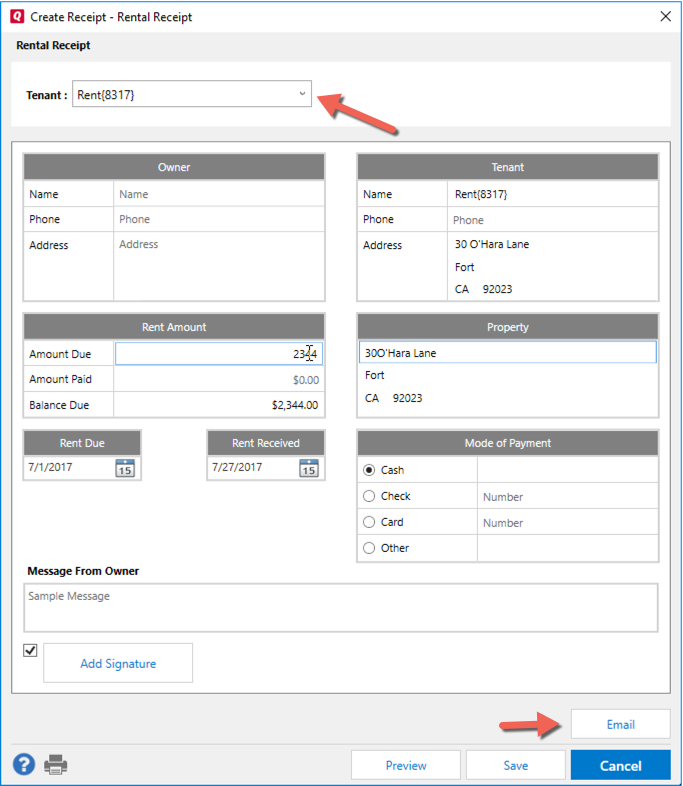

Quicken Home & Business doesn’t include a payroll option and you can’t download a plugin to add a payroll option. The independent payroll application enables you to input employee data and print paychecks. The program doesn’t include a payroll component, but you can use Intuit Online Payroll, a separate Internet-based service, to manage your company’s payroll. Quicken Home & Business is an accounting program for your business that includes the ability to create invoices and statements as well as customer estimates. With this comprehensive solution, you can have complete control of your company paychecks and payroll tax deposits! The online version for NetSuite users is also included in the purchase.

#QUICKEN SMALL BUSINESS INVOICE SOFTWARE#

Quicken Payroll Software for Small Business is ideal for ’s vast client base of over 1,440,000 small business owners who need to run payroll as efficiently and cost effectively as possible.

Available as a complete payroll software solution or an online service, Quicken Payroll simplifies the most complex parts of payroll preparation and gives you more time to run your business. Quicken Payroll for Small Business is an easy-to-use, yet full-featured payroll solution.

0 kommentar(er)

0 kommentar(er)